When investing in factories, real estate, energy, transport, or infrastructure, upfront costs can overwhelm. Our Medium–Long Term Project Funding offers structured loans tailored to cash flow cycles. Execute confidently and sustainably without straining your working capital.

Get in touch

Our financing solutions are carefully structured to align with your project’s cash flow, ensuring smooth execution and repayment without straining operations.

Aligned with project lifecycles. Repayment periods are tailored to your project type, with options for extensions on longer infrastructure projects.

Funding that scales with ambition. We provide large loan amounts, assessed based on feasibility studies and future cash flow projections.

Adaptable repayment plans. Choose balloon payments, step-up/step-down schedules, or annuity-based repayments to align with revenue inflows.

Security that fits the project. Collateral can include project assets, receivables, or third-party guarantees for flexibility.

Fund capital-intensive initiatives without draining working capital or daily operations.

Repayment structures are designed to follow project revenue streams.

Build capacity to enter new markets, sectors, or infrastructure ventures.

Structured loans enhance trust with investors, partners, and off-takers.

Our Medium–Long Term Project Funding is designed for businesses with ambitious, capital-intensive projects. Whether in real estate, manufacturing, or infrastructure, we provide the structured financing to bring big plans to life.

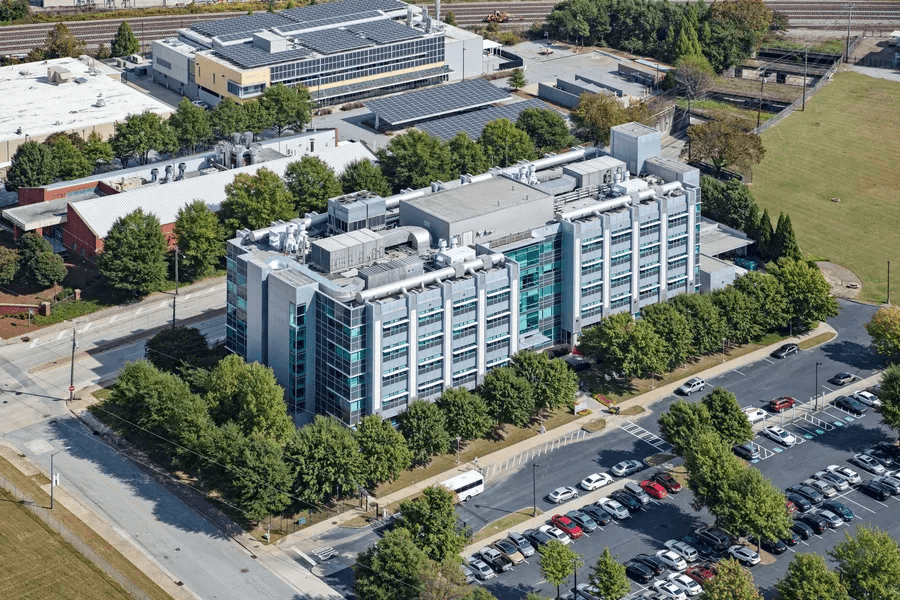

Finance housing estates, commercial complexes, or mixed-use projects with structured loans that align with project lifecycles and sales timelines.

Access financing to build or scale factories and production facilities, ensuring you meet growing demand without exhausting working capital.

Secure long-term capital for energy, transport, or renewable projects, enabling you to deliver large-scale infrastructure with confidence and credibility.

Share project plans, feasibility reports, and cash flow forecasts.

We evaluate project viability, risks, and funding requirements.

A tailored financing package is structured to match revenue timelines.

Funds are released in tranches, with ongoing monitoring for project success.

Turn ambitious plans into reality with financing built around your goals. Partner with us to execute confidently and scale sustainably.